Artificial intelligence (AI) is the most revolutionary technology in a generation. Its ability to instantly generate text, images, videos, and even computer code could drive a productivity boom for businesses all over the world.

The industry is still in its infancy, but Wall Street’s forecasts suggest AI could add anywhere between $7 trillion and $200 trillion to the global economy during the next decade. That’s why technology giants are battling one another for AI supremacy and spending astronomical amounts of money on data center infrastructure and chips.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

According to an estimate from investment bank Morgan Stanley, four technology giants alone could invest a combined $300 billion in capital expenditures (capex) in 2025. Driving that spending will be AI, and with Nvidia (NASDAQ: NVDA) supplying the most advanced chips in the industry for AI development, its stock could also be the biggest winner from the spending boom.

Here’s how much tech giants are currently spending

In order to make “smarter” AI software, developers need to train more sophisticated large language models (LLMs). That requires more data and also more processing power, which is the expensive part.

Outside of cashed-up AI start-ups like OpenAI and Anthropic, most businesses can’t afford to build their own data centers. Instead, they rent computing capacity from tech giants that are building centralized infrastructure.

Based on public filings, here’s how much some of those tech behemoths are allocating to capex, including AI infrastructure:

Chips are a massive component of that spending. During 2023, Nvidia’s H100 graphics processing units (GPUs) were the go-to choice for AI development, granting the company a market share of 98%. They remain a hot seller today, but Nvidia just started shipping its new Blackwell GPUs, which offer a substantial leap in performance.

Image source: Getty Images.

Morgan Stanley’s forecast points to plenty of growth in 2025

Morgan Stanley expects four tech giants to spend a combined $300 billion on capex in 2025. Based on its forecast:

- Amazon could spend $96.4 billion

- Microsoft could spend $89.9 billion

- Alphabet could spend $62.6 billion

- Meta Platforms could spend $52.3 billion

Those figures represent material growth from what those companies are on track to spend in 2024. It’s impossible to know how much of that money will go toward chips, specifically. But Morgan Stanley issued a forecast back in October that suggests Nvidia could ship up to 800,000 units of its Blackwell-based GB200 GPU during the first three months of 2025 alone.

Price estimates range between $60,000 and $100,000 per GB200 GPU (according to Forbes), so those sales could translate into $64 billion of revenue during the first quarter of 2025 (based on an average price of $80,000 per GPU).

Since Nvidia generated $35 billion in total revenue in its most recent quarter, that implies significant growth could be around the corner.

Reports suggest Microsoft is already the biggest buyer of GB200 GPUs, and Nvidia says Oracle plans to build a cluster using over 131,000 of them. The GB200 NVL72 system can perform AI inference at 30 times the speed of the equivalent H100 system, so it’s no surprise there’s a line of buyers that stretches around the block.

Nvidia stock could be the biggest beneficiary of the spending boom

Now, let’s talk about what all of that spending could mean for Nvidia stock because despite its 700% gain over the last two years, it might actually still be cheap.

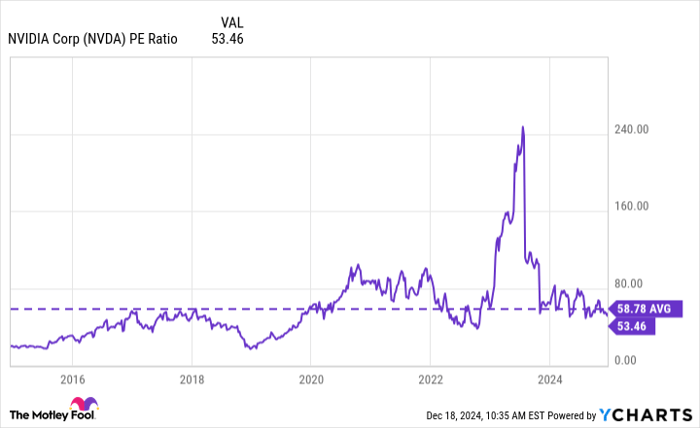

Nvidia is on track to generate $129 billion in revenue during its fiscal 2025 (which ends in January), but it’s also highly profitable. The company has delivered $2.54 in earnings per share (EPS) over the last four quarters, giving it a price-to-earnings (P/E) ratio of 53.5 as of this writing. That’s below its 10-year average of 58.8:

Data by YCharts.

However, the picture gets even better when you look into the future. Based on Wall Street’s consensus forecast for Nvidia’s fiscal year 2026 (which begins in Feb. 2025), the company could generate $4.43 in EPS on $195 billion in revenue.

That means Nvidia stock trades at a forward P/E ratio of just 30.6. In other words, the stock would have to soar over 90% throughout next year just to trade in line with its 10-year average P/E ratio of 58.8.

And there might even be further upside potential based on the fact Nvidia has consistently beaten Wall Street’s expectations.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $825,513!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of December 16, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Anthony Di Pizio has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Amazon, Meta Platforms, Microsoft, Nvidia, Oracle, and Tesla. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Source link

Insights Daily World is your one-stop destination for discovering unbeatable discounts, trending deals, and the latest offers across various products. Stay informed with the newest updates, breaking news, and insightful deals, all designed to help you save and stay ahead

Insights Daily World is your one-stop destination for discovering unbeatable discounts, trending deals, and the latest offers across various products. Stay informed with the newest updates, breaking news, and insightful deals, all designed to help you save and stay ahead