Growth investing is a widespread strategy deployed, with investors targeting companies expected to grow their earnings and revenues at an above-average level. It’s a development that commonly follows through to share outperformance.

These companies typically reinvest back into the business for expansion, commonly at the forefront of innovation. And for those seeking a group of strong growth stocks, Nvidia NVDA, Broadcom AVGO, and Palantir PLTR could all be considerations.

Let’s take a closer look at each.

Broadcom Rides AI Wave

Broadcom has quickly risen to the top concerning AI players, with its latest set of quarterly results fully confirming robust demand. Its FY24 has just ended, with annual revenue of $51.6 billion reflecting a new record and growing 44% year-over-year on the back of strong demand for its solutions.

Broadcom’s earnings outlook shifted positively across the board following the results, landing the stock into a favorable Zacks Rank #2 (Buy). Its next quarterly results are scheduled for March, with early consensus expectations alluding to 36% EPS growth on 22% higher sales.

Image Source: Zacks Investment Research

Palantir Sees Big Demand

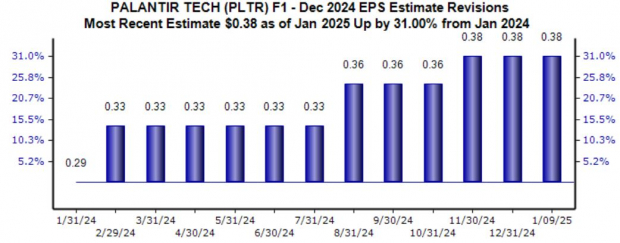

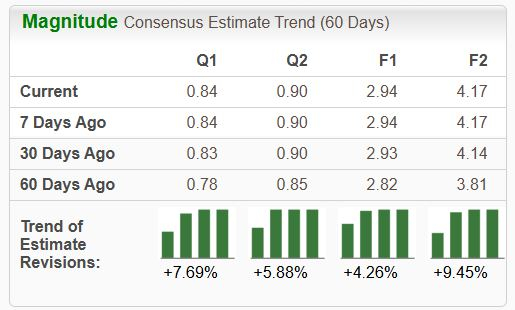

Palantir’s robust share performance has also been fueled by the AI frenzy, with the company’s latest set of quarterly results pleasing investors in a big way. The strong results and favorable commentary have caused analysts to raise their earnings expectations, with the stock sporting a favorable Zacks Rank #2 (Buy).

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

The company’s sales have snowballed thanks to strong AI demand, with sales of $726 million throughout its latest period growing 30% year-over-year and 7% sequentially.

Nvidia Data Center Remains Robust

Investor-favorite and Zacks Rank #2 (Buy) Nvidia continues to fire on all cylinders, with its Data Center results regularly blowing away expectations and posting big year-over-year growth. Like those above, its earnings outlook has brightened nicely over recent months, with positive revisions regularly hitting the tape following quarterly prints.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Jensen Huang, CEO, wrapped up the latest set of quarterly results with a bullish statement: “The age of AI is in full steam, propelling a global shift to NVIDIA computing. Demand for Hopper and anticipation for Blackwell — in full production — are incredible as foundation model makers scale pretraining, post-training and inference.”

Bottom Line

Above-average sales and earnings growth commonly lead to share outperformance, undoubtedly a welcomed development among investors.

And for those seeking companies with bright outlooks, all three above – Broadcom AVGO, Nvidia NVDA, and Palantir PLTR – fit the strategy nicely.

In addition to rock-solid growth, all three sport a favorable Zacks Rank, with positive earnings estimate revisions providing bullish fuel.

Only $1 to See All Zacks’ Buys and Sells

We’re not kidding.

Several years ago, we shocked our members by offering them 30-day access to all our picks for the total sum of only $1. No obligation to spend another cent.

Thousands have taken advantage of this opportunity. Thousands did not – they thought there must be a catch. Yes, we do have a reason. We want you to get acquainted with our portfolio services like Surprise Trader, Stocks Under $10, Technology Innovators,and more, that closed 228 positions with double- and triple-digit gains in 2023 alone.

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Broadcom Inc. (AVGO) : Free Stock Analysis Report

Palantir Technologies Inc. (PLTR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Source link

Insights Daily World is your one-stop destination for discovering unbeatable discounts, trending deals, and the latest offers across various products. Stay informed with the newest updates, breaking news, and insightful deals, all designed to help you save and stay ahead

Insights Daily World is your one-stop destination for discovering unbeatable discounts, trending deals, and the latest offers across various products. Stay informed with the newest updates, breaking news, and insightful deals, all designed to help you save and stay ahead