The Dow closed out the first full week of January with a steep triple-digit loss, marking its fifth weekly decline in six. This dismal price action followed a much hotter-than-expected private payrolls report, which dragged the Nasdaq and S&P 500 sharply lower as well, resulting in a second-straight weekly loss for both.

Investors are losing hope for another interest rate cut this year, with odds for a March cut falling to around 25% from 41% in just one day, per the CME Fedwatch tool. Meanwhile, the 10-year Treasury yield hit its highest level since 2023, and the Cboe Volatility Index (VIX) nabbed solid daily and weekly gains.

Continue reading for more on today’s market, including:

- Analyst casts doubt on Roku stock.

- Tech stock among best picks for 2025.

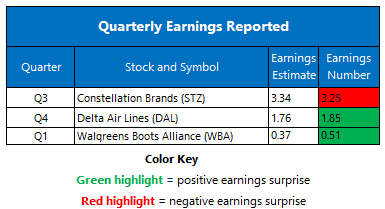

- Plus, 2 air taxi stocks downgraded; Walgreens’ earnings beat; and a fresh look at solar stocks.

5 Things to Know Today

- Electricity provider Constellation Energy (GEG) said it will buy sector peer Calpine in a $16.4 billion cash and stock deal, but regulatory questions remain. (MarketWatch)

- The Trump Organization’s new ethics plan will limit President-elect Donald Trump’s involvement in management and business aspects during his term. (CNBC)

- J.P. Morgan Securities downgraded these air taxi stocks.

- Walgreens Boots Alliance stock popped after earnings win.

- Can solar stocks shrug off post-election blues this year?

Gold, Oil Prices Rally to Nab Weekly Wins

Oil prices settled higher Friday, with cold weather across the U.S. and supply jitters supporting prices. Plus, the U.S. Treasury Department imposed sanctions on Russian oil companies. February-dated West Texas Intermediate (WTI) crude added $3.23, or 4.4%, to settle $77.15 per barrel. Black gold added 4.4% for the week.

Gold prices settled higher as well, brushing off hotter-than-expected jobs data amid uncertainty over Trump’s policies. Gold for January delivery gained 1.4%, to settle at $2,727.90 an ounce. For the week, the safe-haven commodity added more than 1%.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Source link

Insights Daily World is your one-stop destination for discovering unbeatable discounts, trending deals, and the latest offers across various products. Stay informed with the newest updates, breaking news, and insightful deals, all designed to help you save and stay ahead

Insights Daily World is your one-stop destination for discovering unbeatable discounts, trending deals, and the latest offers across various products. Stay informed with the newest updates, breaking news, and insightful deals, all designed to help you save and stay ahead