Four years after hearing the president promise bold action on student debt, most borrowers are still no better off, and many—especially defrauded debtors—are measurably worse off.

Kamala Harris’s crushing electoral defeat at the hands of Donald Trump has caused a flurry of analysis and finger-pointing. Writing in other outlets, I’ve added to the chorus of those who believe that the campaign erred by tacking right to appeal to donors and advisers with connections to Wall Street, Silicon Valley, and the Republican Party.

But my concerns go deeper than this single election. Harris’s doomed candidacy and her mealy-mouthed messaging were symptoms of a bigger problem—namely, the Democratic Party’s lack of commitment to actually governing in ways that improve the lives of the people they claim to serve. Over the past 10 years, I have been deeply immersed in the movement to cancel student debt through my organizing with the Debt Collective. This work has given me a window into the operations of two Democratic administrations.

What I’ve seen has been profoundly alarming.

The Debt Collective has always viewed student debt relief as something of a litmus test—an indicator of an administration’s overall dedication to actually improving working people’s lives. The executive branch has various legal tools that can be used to eliminate federal student loans, whether for targeted groups or across the board, without waiting for Congress to act. All that’s required are public officials who want to do what is right.

Yet both the Obama and Biden administrations showed that they would rather make technocratic tweaks at the margins than effectively come to the aid of student debtors—even those who are victims of fraud, disabled or destitute, or elderly and out of hope. With the clock ticking before Trump takes office, those are the student debtors we are now focused on trying to help.

Over the last few years, we’ve repeatedly asked Education Secretary Miguel Cardona and Under Secretary Jammes Kvaal to meet directly with student debtors and they have always refused. When I recently asked Undersecretary Kvaal to reconsider and make time for our members given the threat the incoming administration poses, he once again declined. The time crunch made “internal meetings” the priority. The next day, I looked at Cardona’s public schedule and saw he was, in fact, traveling for an external meeting—in Maui, Hawaii.

The Debt Collective’s work began in 2014, when we started organizing with students who had been defrauded by for-profit colleges, including the now-defunct Corinthian Colleges, Inc. There was overwhelming evidence of systematic fraud, and millions of borrowers were clearly entitled to relief through what was then a little known legal provision called “borrower defense.” It was only when a few brilliant lawyers, the Debt Collective, and our members alerted people to this obscure authority that officials took notice. After we launched the world’s first student debt strike and a media offensive, then–Education Secretary Arne Duncan made a public promise: “If you’ve been defrauded by a school, we’ll make sure that you get every penny of the debt relief you are entitled to through…as streamlined a process as possible.”

Despite that promise, borrower defense was never streamlined—nor was anything coming close to every penny of relief actually delivered. Instead of efficiently issuing group discharges for sets of borrowers with similar claims, the Education Department forced borrowers to individually apply, suffocating them in red tape and paving the way for Trump Education Secretary Betsy DeVos to try to sabotage relief entirely. There’s a political lesson here: A Democratic administration failing to fight for the most vulnerable members of their base hardly inspires public appreciation or trust and ultimately enables the opposition.

At no point has the Education Department bothered to affirmatively notify borrowers of their right to file a claim (for example, by sending out an e-mail to everyone who had taken out a federal loan to attend one of the law-breaking schools in question). Instead, it fell to the Debt Collective, the Project on Predatory Student Lending, and defrauded students themselves to find eligible borrowers in a piecemeal fashion and organize them to fight for their rights.

Despite public outcry over the for-profit college sector’s decades-long record of abuses—high-pressure marketing tactics geared at single mothers and veterans, subpar teaching, exorbitant costs, life-destroying student loans, and worthless degrees—Obama officials maintained cozy relationships with the industry. Several became executives in the predatory for-profit Apollo Education, owner of the University of Phoenix, including Tony Miller, Obama’s deputy secretary of the Department of Education. Obama’s Education Undersecretary Ted Mitchell fought to keep predatory for-profit schools alive, and facilitated the sale of scam schools to ECMC (an abusive debt-collection company). Today, he makes over $800,000 a year working as a lobbyist for colleges—including for-profit colleges—arguing against mass student debt cancellation.

It remains to be seen if Biden’s hires will also make their way through this golden revolving door. But we can already say that they have been far too kind to education profiteers. Mere weeks before leaving his office as the COO of Federal Student Aid this year, Richard Cordray attended a promotional event for Lincoln Tech, a for-profit college based in New Jersey that has a troubling history of misconduct. Cordray joined executives for a smiling photo op and praised the company on social media, passing it off as a legitimate educational institution. No matter that it had just been party to a lawsuit attempting to block the use of borrower defense. For all the Biden administration’s talk of “accountability,” the for-profit sector has thrived during his administration—and is set to have an even more lucrative field day under Trump’s watch.

Today, we are in a position eerily similar to the one we found ourselves in at the end of Barack Obama’s second term, when desperate students waited with bated breath, wondering if they’d see justice—or be thrown to Trump’s wolves.

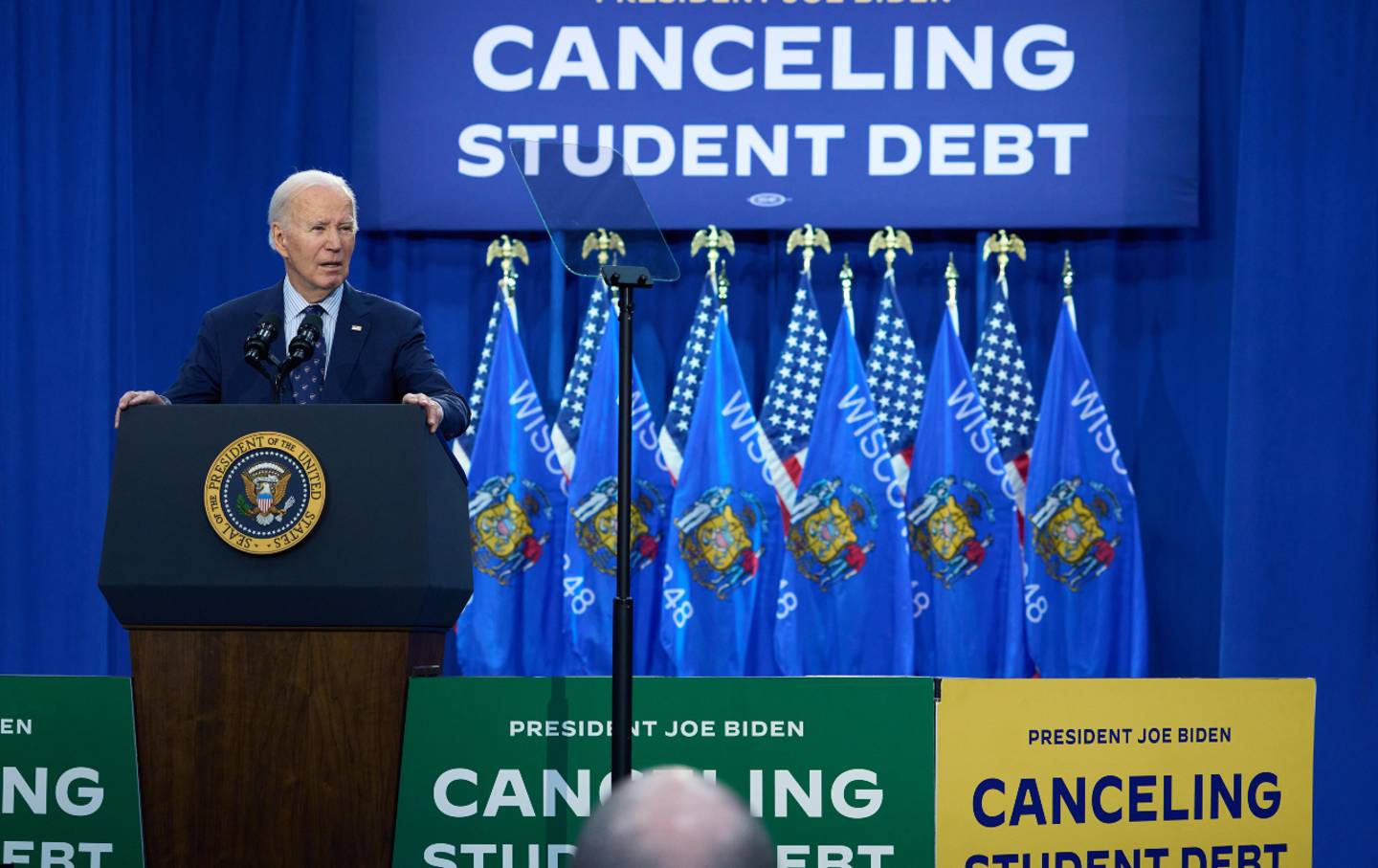

Most borrowers are no better off than they were four years ago, and many—especially older and defrauded debtors—are measurably worse off. Biden’s headline-grabbing and heart-thrilling promise of broad student loan relief for 40+ million borrowers never came to pass. And so people continue to pay the piper, making wrenching choices every month: Should scarce paychecks go to rent, doctor visits, childcare—or to student loans?

Democrats like to blame the Supreme Court for their broken promises and the fact that these loans still weigh heavy on millions of households. In truth, Biden’s team deserves significant blame. Instead of eliminating federal loans in one fell swoop, White House and Education Department officials chose to means-test cancellation—a process that required otherwise unnecessary bureaucracy. They then took six weeks to release a simple online application and dragged their feet on approvals. This slow-walking bought time for billionaire-backed right-wing litigants who, predictably, found a sympathetic hearing at the Supreme Court.

But even that didn’t need to be the end of the story. Biden and company could have played hardball and ordered immediate cancellation, as many lawyers and advocates urged them to do. Instead, they took a procedural approach, engaging in a lengthy, redundant, and doomed rule-making process that—precisely as the Debt Collective and others warned—has yielded not a penny for struggling borrowers. What was the point of this elaborate pantomime? (Would bolder action have been proof against right-wing lawsuits? Of course not. But making conservatives fight to reinstate already-canceled loans would have put Democrats on the logistical and moral high ground, while offering relief difficult to claw back once it’s been implemented.)

Too many people within the Biden administration seem to think that they’ve done enough. Instead of lingering on their failures, they boast of the relief they have granted to date: approximately $175 billion for nearly 5 million borrowers, by the government’s count.

That may sound like a lot, but the numbers are deceiving. First, 99 percent of this cancellation, however welcome, was already required by law. Much of that has gone to three groups. The first includes recipients of Public Service Loan Forgiveness (PSLF), a George W. Bush era program designed to incentivize people to work in nonprofit fields (think teachers and nurses). The second had already been enrolled in Income Driven Repayment for two decades or more. The third are people who had been defrauded by predatory for-profit colleges (in other words, the very people the Debt Collective has been fighting alongside for years). Adding insult to injury, the numbers the administration proudly touts in press releases often don’t match reality. Approximately one in four (or 135,000) defrauded Corinthian Colleges borrowers—are still waiting for the cancellation they were promised in 2022 to come through.

Popular

“swipe left below to view more authors”Swipe →

Democrats made their flagship message in the 2024 election “we’re better than the other guys.” But that wasn’t enough to win. Democrats need to show that they actually stand for something positive—and that they are actually willing to fight and deliver. You don’t need a degree in political science (or the lifetime of student loans required to acquire it) to understand that a promise to cancel student loans for over 40 million people is not the same thing as actually lowering or eliminating the balance owed on over 40 million people’s accounts.

In the Obama-to-Trump transition, Arne Duncan, John King, Ted Mitchell, and others could have gone to the mat for debtors. Instead, they swung through the revolving door and left us to the whims of Betsy DeVos.

The Biden administration still has a few weeks left to reverse this trend, and I hope it does. This week, White House Chief of Staff Jeff Zients signaled that more student debt relief might be coming as part of the “sprint” to January 20. But if it’s merely another sprinkle of PSLF cancellation, the public won’t be impressed. That kind of relief should have been processed years ago.

Zients and his colleagues need to do everything in their power to spare student debtors from financial devastation right now, using every tool at their disposal—and they have quite a few. Debt Collective has long argued that all student loans should be wiped out. At a minimum, scammed for-profit students, debtors over 50, and borrowers in long-term default (which means they are likely impoverished and highly unlikely to ever be able to repay) should all receive full cancellation before Trump returns.

Doing so wouldn’t only be good for student debtors and their families—though it would certainly change their lives. It will also be good for the Democratic Party, which has lost the faith of so many and by losing this faith, has allowed the authoritarian right to gain power. The price of sticking to the failing status quo has proven to be extremely steep. It’s time for a different approach.

More from The Nation

When social structures corrode, as they are doing now, they trigger desperate deeds like Mangione’s, and rightist vigilantes like Penny.

Contrary to what conservative lawmakers argue, the Supreme Court will increase risks by upholding state bans on gender-affirming care.

There may be a dark shadow hanging over this year’s holiday season, but there are still ways to give to those in need.

Thomas and his colleagues at Empowerment Avenue are subverting the established narrative that prisoners are only subjects or sources, never authors of their own experience.

While very few Americans would sincerely advocate killing insurance executives, tens of millions have likely joked that they want to. There’s a clear reason why.

Insights Daily World is your one-stop destination for discovering unbeatable discounts, trending deals, and the latest offers across various products. Stay informed with the newest updates, breaking news, and insightful deals, all designed to help you save and stay ahead

Insights Daily World is your one-stop destination for discovering unbeatable discounts, trending deals, and the latest offers across various products. Stay informed with the newest updates, breaking news, and insightful deals, all designed to help you save and stay ahead