Broadcom AVGO shares have ripped more than +30% since the chip giant posted favorable results for its fiscal fourth quarter last Thursday. Setting a bullish tone, Broadcom has seen high demand for its custom artificial intelligence chips which have been crucial to powering AI data centers.

Cracking a $1 trillion market cap for the first time, investors may be wondering if the rally in Broadcom stock can continue.

Image Source: Zacks Investment Research

Broadcom’s Q4 Results

Thanks to its AI expansion, Broadcom’s Q4 sales increased 51% year over year to $14.05 billion although this slightly missed Zacks estimates of $14.06 billion. On the bottom line, Q4 adjusted net income came in at $6.96 billion or $1.42 per share. This edged the Zacks EPS Consensus of $1.39 and rose 28% from $1.11 a share in the comparative quarter.

Overall, Broadcom’s top line expanded 44% in fiscal 2024 to a record $51.57 billion as AI revenue more than tripled to $12.2 billion. Annual EPS increased 26% to $4.87 versus $3.86 per share in FY23.

Image Source: Zacks Investment Research

Optimistic Guidance & Outlook

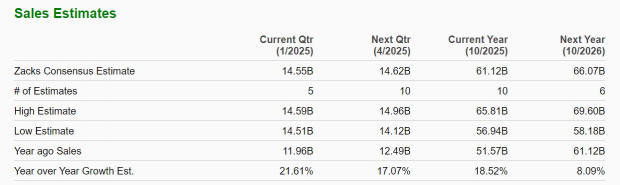

As a key chip supplier to Apple AAPL, Broadcom CEO Hock Tan stated the company has also added two major hyper-scale data center customers. Attributed to such, Broadcom expects its fiscal first quarter revenue to increase 22% to $14.6 billion with the current Zacks Consensus at $14.55 billion (Current Qtr Below).

Furthermore, the chip giant projects AI revenue to soar 65% during Q1 to $3.8 billion. Based on Zacks estimates, Broadcom’s total sales are expected to expand 18% in FY25 and are forecasted to increase another 8% in FY26 to $66.07 billion. Optimistically, Broadcom thinks its AI business could bring in $60-$90 billion in annual sales by 2027.

Image Source: Zacks Investment Research

AVGO Performance & Valuation

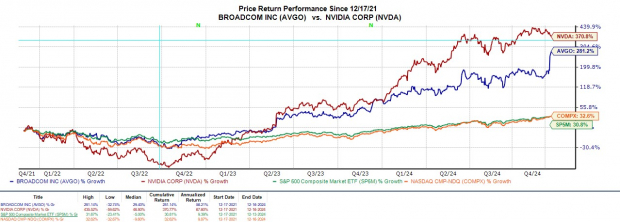

Starting to challenge Nvidia’s NVDA market dominance, Broadcom stock has soared over +100% this year to vastly outperform the broader indexes.

Image Source: Zacks Investment Research

Trading around $241 a share, AVGO is at a 36.7X forward earnings multiple. While this is a premium to the S&P 500’s 25.7X, Broadcom stock trades beneath Nvidia’s 45.6X and is on par with their Zacks Electronics-Semiconductors Industry average.

Although Broadcom is at a fairly reasonable P/E multiple, AVGO does trade at premiums to the broader market in terms of other key valuation metrics as well, like many of its big tech peers.

Image Source: Zacks Investment Research

Bottom Line

Following such an extensive rally, Broadcom stock lands a Zacks Rank #3 (Hold). Thanks to high demand for its AI chips, Broadcom’s sales outlook has certainly become more appealing to long-term investors but more upside from current levels will likely depend on what is hopefully a trend of positive earnings estimate revisions in the coming weeks.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +24.1% per year. So be sure to give these hand picked 7 your immediate attention.

Apple Inc. (AAPL) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Broadcom Inc. (AVGO) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Source link

Insights Daily World is your one-stop destination for discovering unbeatable discounts, trending deals, and the latest offers across various products. Stay informed with the newest updates, breaking news, and insightful deals, all designed to help you save and stay ahead

Insights Daily World is your one-stop destination for discovering unbeatable discounts, trending deals, and the latest offers across various products. Stay informed with the newest updates, breaking news, and insightful deals, all designed to help you save and stay ahead